Getting financial advice

Good news: the ARP will pay for eligible members to receive one round of impartial retirement advice from our appointed firm of financial advisers.

We want you to make the right retirement choices for your circumstances, so have appointed Origen Financial Services Limited (Origen), a long-standing, regulated, national firm of financial advisers.

How it works

If you’re eligible, the ARP will pay for you to receive one round of impartial financial advice from Origen.

This is a really valuable benefit – typically, impartial financial advice can cost £3,000 or more.

With Origen, you’ll receive a personal recommendation from an experienced financial adviser who is an expert on retirement advice – at no cost to you and with no obligation.

Can you use your own choice of financial adviser?

Alternatively, if you’re eligible and you’d prefer to use your own choice of financial adviser, the ARP will make a one-off contribution of up to £1,000 (plus VAT) towards the cost of financial advice relating to your ARP benefits.

Important

You can either receive one round of paid-for advice from Origen or receive the one-off contribution towards the cost of your own financial adviser. You can’t receive both.

Watch their summary video

Origen

We’ve summarised this offer ‘in person’ to bring it to life and to introduce you to Origen.

Watch our short video for more details.

Who are Origen?

For more detail about Origen, head to their website.

Paid-for advice from Origen

Your Origen adviser will review your circumstances, preferences and ARP benefits.

- If you have benefits in more than one section of the ARP, this will include all your ARP benefits.

- It will also include any DC benefits you have in the ARP as well as any DC benefits that are eligible for switchback into the ARP.

- They’ll then recommend how you take your ARP benefits. The process may involve several phone calls.

- They’ll provide you with a written copy of their personal recommendation.

- You’re under no obligation to take their advice, but we encourage you to consider it carefully.

- They’ll also help you to complete the relevant forms once you’ve made your decision.

You’re eligible for one round of paid-for financial advice from Origen if:

- you haven’t yet retired, and

- you’re age 55 or over (or you’re over your protected minimum retirement age), and

- you live in the UK (see below for the terms that apply for overseas members), and

- you haven’t received the £1,000 contribution towards the cost of your own financial adviser.

The offer is for one round of paid-for impartial financial advice from Origen, so you should think carefully about when to take it up.

In most cases, this is likely to be when you receive (or request) a retirement quotation.

When will you receive a retirement quotation pack?

You’ll automatically receive a retirement quotation pack in the run-up to your Normal Retirement Date – the last day of the month in which you reach age 65.

However, you can retire before your Normal Retirement Date, subject to pensions law and any protected pension age you may have. (See Your DB benefit summary.)

If you want to consider early retirement, you’d need to request a retirement quote by contacting the helpdesk.

What's covered in one round of advice?

One round of advice could involve several phone calls over several weeks.

Planning for your advice

You should therefore consider contacting Origen soon after you receive your retirement pack.

This will allow enough time for you to:

- collate any additional information (such as details on other pensions or savings you may hold),

- go through the advice process,

- consider Origen’s recommendation,

- make your decision, and

- fill out and submit the relevant forms (with Origen’s help).

How long do the figures in your retirement quotation last?

Some figures in your retirement quotation are only guaranteed for a period of time, so you’ll need to complete the advice process before the end of the guarantee date.

Contact Origen to arrange an initial call. We recommend doing this once you have received your retirement pack and explored your options on the Retirement Options Tool.

Making the call

You can contact them on the following number:

- 0800 161 5603

Monday to Friday, 9am to 5pm except bank holidays.

In writing

You can also contact them by email:

You’ll need to let them know that you’re a member of the ARP and that you’d like to arrange an advice call.

You’ll also be able to arrange a call back from Origen directly from the Retirement Options Tool. You will receive access to the tool when you request a retirement quotation.

Origen is authorised to provide advice in the UK only.

If you live overseas, Origen can give you detailed guidance about your options and possible next steps – which the ARP will pay for one round of – but not formal advice.

If you’d like formal financial advice, you’d need to appoint a suitable financial adviser in the country where you live. They’d need to be familiar with UK tax and pension laws.

If you’re ineligible for paid-for advice (for example if you’re under your protected minimum retirement age) or you wish to receive further advice in the future from Origen (having taken advantage of the paid-for advice), we’ve negotiated heavily discounted rates with Origen.

You’d need to meet the cost of the advice yourself, but this would be much cheaper than the rates you’d be quoted on the open market.

Contact Origen for details. See 'To arrange advice with Origen' for their contact information.

An alternative option

Origen’s advisers have been fully trained on the ARP and the way it works, so we’d encourage you to use them for financial advice, but you don’t have to.

If you’re eligible and you’d prefer to use your own choice of financial adviser, the ARP will make a one-off contribution of up to £1,000 (plus VAT) towards the cost of financial advice relating to your ARP benefits.

Please refer to the form (below) for details of how you can claim this contribution and the terms and conditions that apply.

You’re eligible for this one-off contribution if:

- you haven’t yet retired, and

- you’re age 55 or over (or you’re over your protected minimum retirement age), and

- you live in the UK.

This is an alternative option. You can’t get paid-for advice from Origen and claim the contribution towards getting advice elsewhere.

If you have benefits in more than one section of the ARP, you can only claim this contribution once. However, your adviser should take all of your benefits into account within their advice, so make sure you inform them of all benefits your hold in the ARP.

Financial advice and DC savings

If you’re eligible and you have DC savings in the ARP or DC savings which can be transferred back into the ARP at retirement (such as those in the Aon MasterTrust), the ARP will pay for you to receive one round of impartial financial advice from Origen.

Alternatively, if you’re eligible and you’d prefer to use your own choice of financial adviser, the ARP will make a one-off contribution of up to £1,000 (plus VAT) towards the cost of financial advice relating to all your ARP benefits (including any DC savings that are transferred back into the ARP).

Sourcing a financial adviser

If you don’t want to use Origen and you don’t have an appointed IFA, there are organisations that can help you find one.

They can also give you a list of some of the things to check when deciding who to appoint. Some of these organisations (and how to contact them) are set out below.

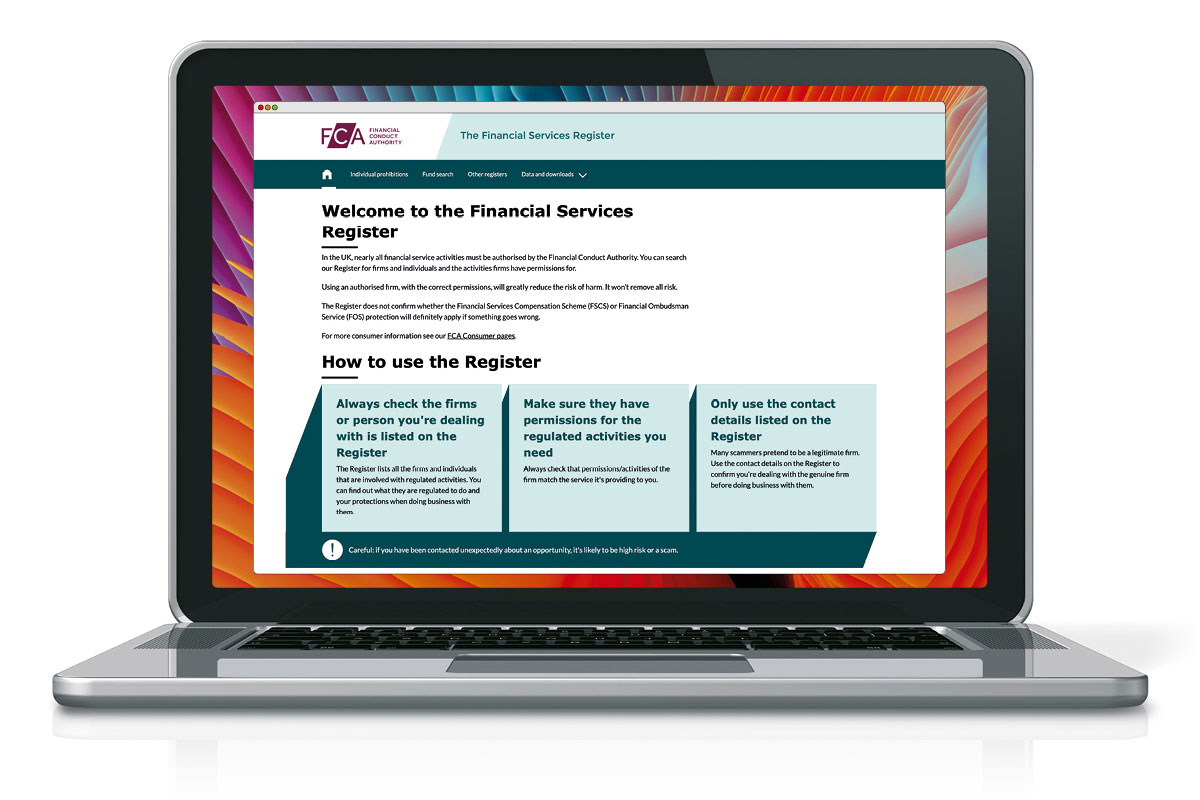

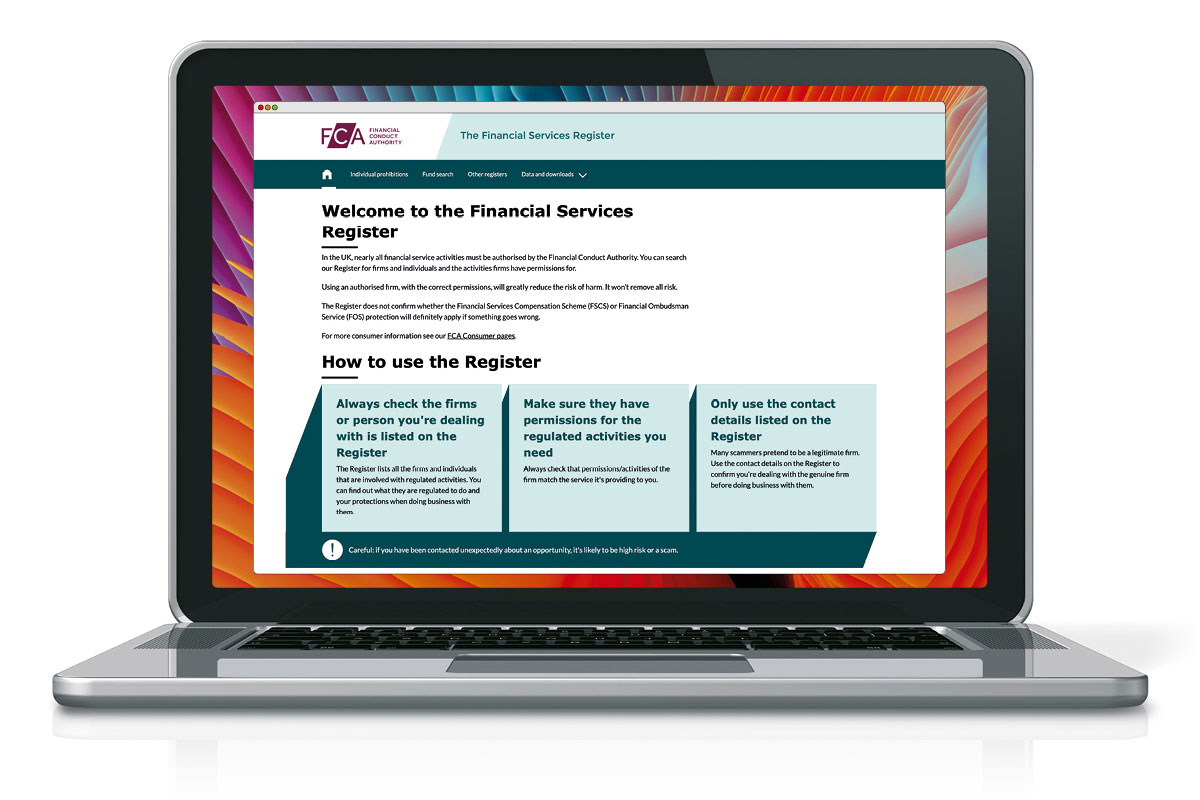

The Financial Conduct Authority (Q4 update)

The Financial Conduct Authority (FCA) regulates financial services firms (including financial advisers) and financial markets in the UK.

Its website has a section on choosing and using a financial adviser, including the questions you should ask.

Check your financial adviser is regulated and authorised

Before you appoint a financial adviser, you should check the firm you’re dealing with is suitably authorised and registered.

They must be:

- qualified at Level 4 or above of the Qualifications and Credit Framework (equivalent to the first year of a university degree); and

- have an up-to-date Statement of Professional Standing.

How can I find out more?

The FCA publishes a searchable online register of regulated financial advisers.

Alternatively, call their helpline and they’ll check for you:

- Phone:

0300 500 8082 (UK) or

+44 207 066 1000 (from overseas)

MoneyHelper (Q4 update)

MoneyHelper has information about consumer finances, including access to independent financial advice.

Important

The law doesn’t allow the Trustees, Aon or anyone connected with the ARP to give you financial advice.

The terms of the offer for paid-for impartial financial advice from Origen is subject to change and will be kept under review. The Trustees reserve the right to withdraw the offer at any time. We’ll let you know if this happens.